Advisor real-estate planning software

Turn real estate into client-ready advice in minutes.

Advisors are stuck in spreadsheets and workarounds — even though real estate makes up 50–70% of client wealth.Leveridge starts with the client’s goal (income, liquidity, risk) and optimizes their real estate—uniting performance, liquidity, and tax impact in one clear view.

"If I had it today, it would be off to the races." —Early Advisor

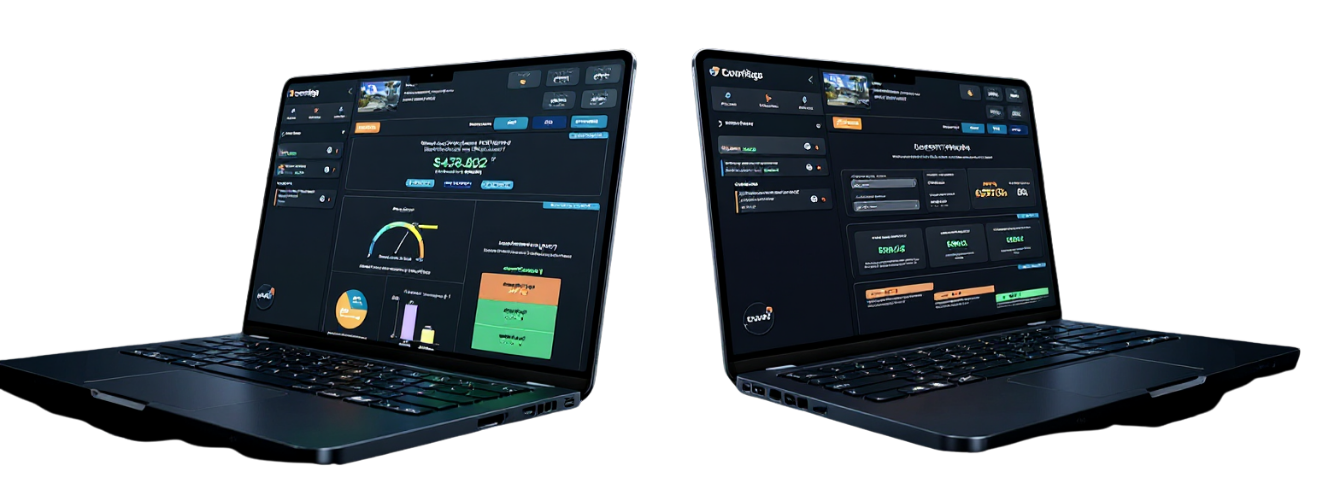

Leveridge at a glance

What it is — Goal-driven real-estate planning: start from the client’s objective and produce a defensible strategy.

What it eliminates — Spreadsheets, Zillow/Redfin lookups, eMoney/RightCapital workarounds, and back-and-forth with realtors and lenders.

Who it’s for — RIAs, family offices, and advisor teams that include real estate in client plans.

What it delivers — Instant clarity on performance, liquidity, and goal fit (tax impact included)—in one client-ready view.

What advisors are saying

"Right now, my #1 solution is me + Excel. It’s all homemade." —Early Advisor

"Any advisor doing retirement planning with real estate would use the heck out of this." —Early Advisor

"I get asked all the time: ‘How do I model this in RightCapital?’ There’s no great way — I need a clear tool." ** —Early Advisor**

Built for client conversations from day one

Performance

Instant view vs. benchmarks (cash flow, yield, IRR) so you can compare options with confidence

Liquidity

What clients can actually access — beyond paper equity — grounded in income and market context

Net Proceeds

The true net number after taxes, costs, and loan payoff — what your client really walks away with

Mortgage Health

Debt coverage, loan terms, and refinance readiness in one view

Depreciation Timeline

Remaining depreciation and recapture exposure — so you can anticipate tax consequences and plan ahead

Note: Not a one‑time calculator. Built for recurring reviews and client conversations

From input to insight in 3 steps

Enter property & tax details → Simple setup, no spreadsheets.

See key outputs: performance, liquidity, net proceeds, depreciation → Client-ready in minutes..

Share in your client meeting → Transparent numbers you can stand behind.

What’s coming next

Near-term features and longer-term roadmap, guided by advisor feedback.

Coming Soon

Keep · Sell · 1031/DST comparisons: Side-by-side analysis of scenarios, including tax impact and what-ifs.

PDF exports: Client-ready outputs you can drop directly into planning conversations.

Tax-doc upload: Client-ready outputs you can drop directly into planning conversations.

Portfolio view: See all properties in one dashboard, with a simple Leveridge Grade.

Goal-aware recommendations: Start from a stated client goal (e.g. $2,000 income gap) and compare which strategy best fits.

On the Roadmap

Execution partners: Direct connections to lenders, DST sponsors, and 721/UPREIT providers for seamless analysis → execution.

Planning tool integrations: eMoney, RightCapital, Holistaplan — plus automated goal mapping from the financial plan.

Compliance toolkit: Built-in disclosures and audit-ready exports for compliance review.

AI-driven planning insight: Interpret the client’s full plan automatically and recommend the real-estate strategy that best meets goals.

Frequently Asked Questions

Does Leveridge replace my planning software?

No. Leveridge feeds your plan with accurate real-estate analytics and client-ready outputs.What’s included on day one?

Performance, Liquidity, Net Proceeds (if sold), Depreciation Timeline — with transparent, editable assumptions.Does Leveridge do keep/sell/1031 comparisons?

Not yet. Today, Leveridge gives advisors clarity on property performance, liquidity, net proceeds, mortgage health, and depreciation — with assumptions you can edit. Keep/sell/1031 comparisons are on our near-term roadmap. Longer-term, our vision is to start from the client’s goal (like closing an income gap) and recommend the strategy that best fits.Are PDFs and integrations available yet?

PDF exports and tax-doc upload are coming soon. Planning integrations and execution partners are on the roadmap.Does it support commercial or >4 units?

Day one supports residential 1–4. Expansion to select commercial is on the roadmap.Pricing?

Advisor SaaS (per-seat with firm tiers). Early-access pricing available for the MVP cohort.How secure is my data?

Data encrypted in transit and at rest; minimal PII; building toward SOC 2 readiness.

Early-access onboarding starts Oct 14

Real-estate planning belongs in every financial plan

This is where it begins.

Request early access to join the MVP cohort.

We’ll confirm your seat and send onboarding details within 1 business day.

© 2025 Leveridge. All rights reserved. Privacy · Terms · Contact